Boston-based equity firm now holds all Community Bank locations

by Gretchen Sporleder Orr

WALSENBURG— Trouble has been a’brewing for quite some time for Community Banks, which includes the Walsenburg branch and annex in La Veta.

Last Friday at 4 pm, the local bank at the corner of Fifth and Main in Walsenburg and the La Veta facility were closed down by the FDIC. Signs were posted on the doors informing the public that the bank had been taken over, but that banking services would not be interrupted and would resume normally on Monday. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Bank Midwest, National Association, Kansas City, Missouri, to assume all of the deposits of Community Banks of Colorado. Depositors of Community Banks of Colorado will automatically become depositors of Bank Midwest, National Association, which is owned by National Bank Holdings (NBH) of Massachusetts.

Customers with questions about the seizure and sale should call the FDIC toll-free at 1-800-405-1439. The phone number will be operational from 8 am to 8 pm, MDT. Interested parties also can visit the FDIC’s Web site at www.fdic.gov/bank/individual/failed/commbanksco.html.

The World Journal first reported in late December of 2010 that, according to financial stability figures compiled by BauerFinancial Inc., Community Banks’ rating had dropped from a two star rating (problematic) to zero, their lowest rating as of the end of September 2010. Criteria used in determining these rankings include the bank’s capital ratio, profitability/loss trend, delinquent loans, chargeoffs and repossessed assets.

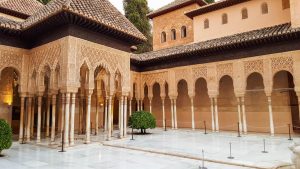

The Greenwood Village, CO based bank made World Journal headlines again in early August 2011 when 16 of 33 Community Banks of Colorado banking centers, as well as the Community Banks of Colorado name were purchased by the Boston based private equity firm, NBH Holdings Corp, which also purchased Bank Midwest in 2010. The Walsenburg branch was not included in that sale, and was expected to continue operations under a new name.

NBH also acquired the Greeley, Colorado based Banks of Choice last July, and owns Hillcrest Bank with five banking centers in Colorado. NBH’s actions are viewed as a strong vote of confidence in Colorado’s future, and the company is reportedly considering moving its headquarters to Denver. “This acquisition, coupled with our recent acquisition of Bank of Choice, reflects our confidence in Colorado’s future and our commitment to playing a positive role in helping the communities we serve to thrive and prosper,” NBH CEO Tim Laney said in a press release. “Our focus is on delivering common-sense banking services that help individuals and small and medium-sized businesses achieve their financial goals.”

Community Banks seems to be in a strong position from here on out, with well financed and committed ownership.